how far back does the irs go to collect back taxes

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

What To Do If Your Tax Refund Is Wrong

IN GENERAL the IRS has 3 years from the date a return is filed to make an assessment and 10 years from the assessment to collect any deficiencies.

. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Theoretically back taxes fall off after 10 years. How many years can the IRS collect back taxes.

The IRS can go back up to. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. Further the IRS will only allow you to collect on tax refunds owed to you within the last three years.

How far back does IRS go for unfiled taxes. After the IRS determines that additional taxes are due the IRS has 10 years to collect unpaid taxes. The IRS can go back as far as six years but generally youll only see audits for up to three years.

Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. How far can IRS go back and audit income taxes.

After that the debt is wiped clean from its books and the IRS writes it off. The IRS will require any taxpayer to go back and file your last six years of tax returns. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Most taxpayers can rest assured that after 3 years it is highly unlikely. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. In most cases the IRS goes back about three years to audit taxes.

How Many Years Can The Irs Collect Back Taxes Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. If you are owed a refund from four years ago or later you forfeit the rights to. This means that the IRS can in theory go back decades to assess taxes and penalties when returns were not filed but this rarely actually happens.

However in practice the IRS rarely goes past the past six. If the IRS goes back to collect on someones unfiled tax returns before they take the opportunity to rectify the problem they could face immense fees. The IRS 10 year window to collect.

Taxpayers are encouraged by the IRS to file all missing tax returns if possible though. IRS Previous Tax Returns At the very most the IRS will go back six years in an. Can the IRS collect after 10 years.

The IRS 10 year statute of limitations starts on the day that your.

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

Irs Bank Levies Can Take Your Money Debt Com

What Does The Irs Do And How Can It Be Improved Tax Policy Center

How Far Back Can The Irs Audit Your Tax Returns

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

Know What To Expect During The Irs Collections Process Debt Com

:max_bytes(150000):strip_icc()/mature-couple-calculating-home-finances-506033706-5bd22c53c9e77c00585cc074.jpg)

How Many Years Can You File Back Taxes

Banks Battle Against Irs Reporting Isn T Over American Banker

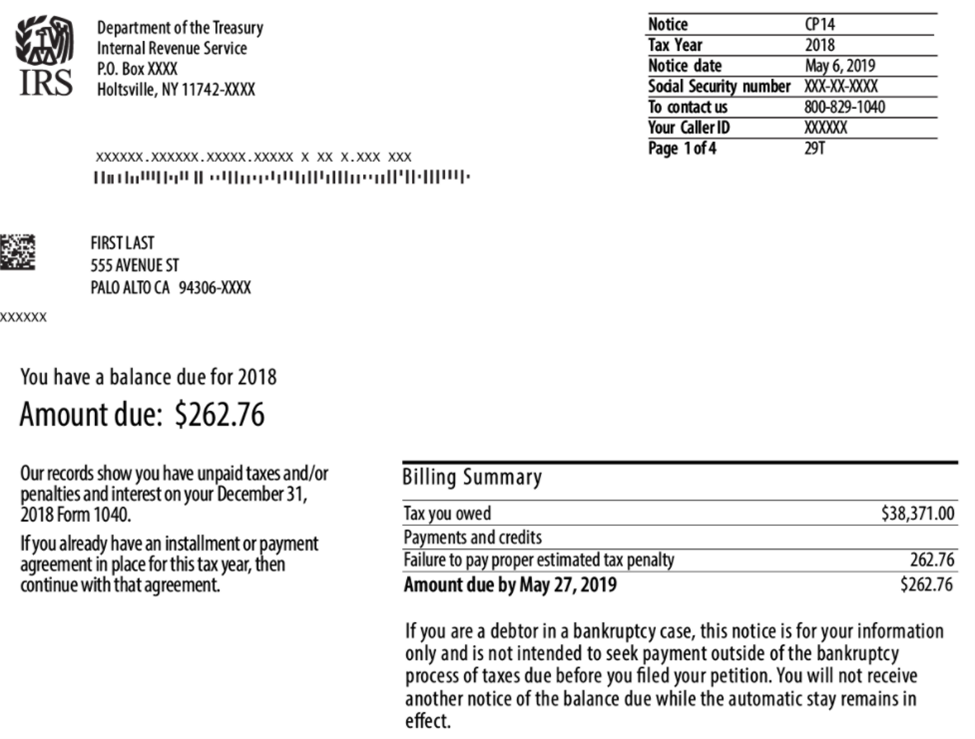

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Does The Irs Forgive Tax Debt After 10 Years

How Far Back Can The Irs Collect Unfiled Taxes

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

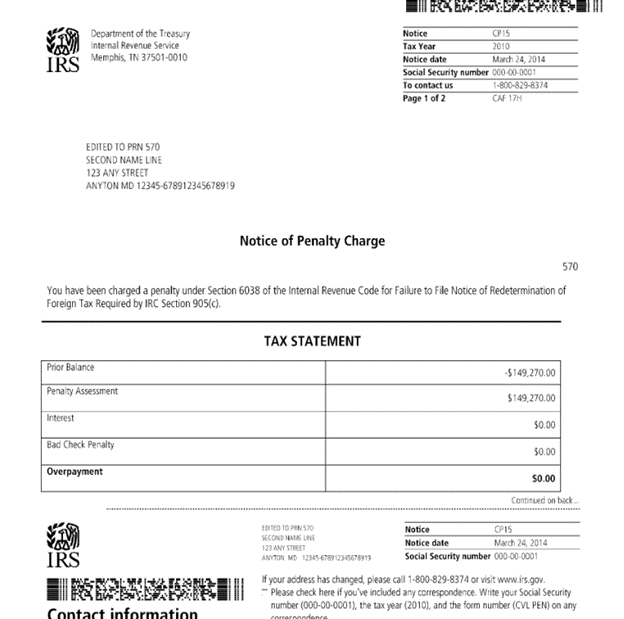

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Are There Statute Of Limitations For Irs Collections Brotman Law

How Far Back Can The Irs Go For Unfiled Taxes Abajian Law

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group